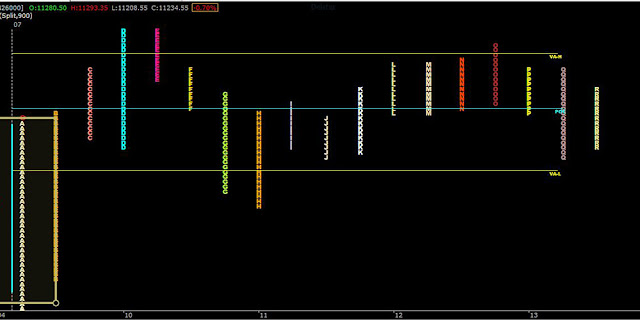

Trading is a continuous learning experience. Market Profile is one of the best tool to organize market

generated information and help in spotting Intraday

and positional trading opportunities. Market Profile is not a time-based chart

rather it organized the Trading Data

and charts the relative frequency of trading at various price levels. By

organizing the trading data in terms of Alphabets (TPO) one can Study the Market

structure and market dynamics. The structure depicted by the Market Profile

reflects market-generated information; it represents the actual buy and sell

orders transacted in the market place.

Let’s look at the important

concepts of Market Profile

1. TPO

TPO or Time Price

Opportunity is the basic building block of Market Profile. Each and every

letter in the chart represents a TPO. Which in turn represents a point of time

where the market touches a price. Each consecutive letter generally denotes a

30min period of Market Activity.

2. Initial Balance (IB)

Initial Balance represents the

first hour of trade. Typically the high and low range of the letters ‘A’ &

‘B’. Longer the length of the Initial Balance stronger the conviction of Long term and Short term players. It’s

generally the first 60-mins of trading sets the tone of the day and gives us an

upper and lower price range to use as a reference point for the day

3. POC

The price that recorded the highest trading activity.

4. Value

Area

The Value Area represents the range of prices that contain 70% of

a day’s trading activity.

5. Value

Area High (VAH)

The upper level of the value area.

6. Value

Area Low (VAL)

The lower level of the value area.

When there is a series of

single tail letters above VaH & VaL, it is called as a single print buying

&selling tail respectively. This kind of tail represents a strong reaction

by the Other time frame trader(OTF).