|

| Add caption |

Introduction

Real Time Data from NSE,

BSE & MCX is distributed to various data vendors as

4 different levels.

These levels are mainly based upon the amount of RealTime Market depth (order book) provided by the exchanges.

This precision and the knowledge of Market Pricing is far more important for the

day Traders than for a long term investor.

·

Level 1

·

Level 2 / Level 3

·

Tick By Tick (TBT)

What is Market Depth?

Market depth is the order book or an electronic

list of buy and sell orders. This list is organized by price level and updated

to reflect real-time market activity.

Most of today’s trading platforms offer some type of market depth display. This

allows the traders to see the “buy and sell orders”, waiting to be executed.

This could include the best bid and ask prices and the size of all

the bids and offers.

The Market Depth, therefore, mainly segregates, the different levels of the

real time data feed from the NSE, BSE & MCX.

Level I Real Time Data from NSE, BSE &

MCX

Level 1 data includes only the Real Time Data

of the first level in the order book.

This includes the Best Bid and Best Ask, plus the total accumulated Volumes Displayed as Bid Size and Ask Size.

Depending on the exchange the number of orders might also be made available for

each side as order.

Currently, the number of orders are not provided by any exchange in India.

The Basic market data is known as level 1 market data, and mainly includes the

following information:

·

Bid price: The highest price that a trader has offered and is

willing to buy the asset at.

·

Best Bid size: The number of shares, lots or contracts that are

available at the bid price.

·

Ask price: The lowest price that a trader has offered and is

willing to sell the asset at.

·

Best Ask size: The number of shares, lots or contracts that are

available at the ask price.

·

Last Traded Price: The price of the most recent trade.

·

Traded Quantity: The number of shares, lots or contracts traded in

the most recent trade.

Level 1 market data provides all of the

information needed to trade using most trading systems.

If you trade a price action or indicator

based strategy, then Level 1 market data should satisfy your informational

needs.

Level 1 Data is also sufficient for complex indicators, including Market Profile, Market Balance, Delta Divergence etc.

If you are not doing Depth of Market Trading, Level 1

data is all you need. Scalpers who trade based on changes in how other traders

are bidding and offering, will need Level 2 Market Data.

This type of quotation system is a step up

from the Level 1.

Data providers offer Level 2 market data at a premium to Level 1.

It offers extra information that is neither useful for normal day traders nor

for long term investors.

Level 2 market data is also known as the ‘order book’. Level 2 market data

shows the trader a bigger picture of the market order flow.

This because it shows the orders that are currently pending for the market.

It is also known as the ‘depth of market’ (DOM) or ‘market depth’.

This is because it shows the number of shares or lots that are available at

each bid and ask prices.

In Level 1, the trader was only able to see the best prices for buying and

selling.

He could not look any deeper into the details of other less competitive orders

on the system.

The distribution of noncompetitive orders is important to institutional

investors who plan to buy or sell large blocks of shares.

Depending on the exchange the level of market depth (of the order book) can be

5, 10 or 20 levels.

Normally the level of depth is 5 for Level 2, Real Time Data from NSE, BSE & MCX.

How can Level 2 Market Data be Viewed ?

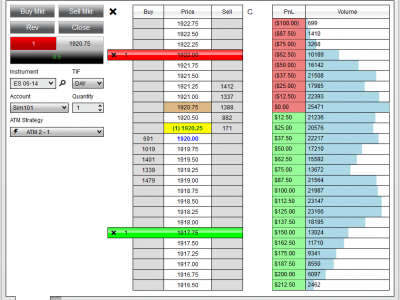

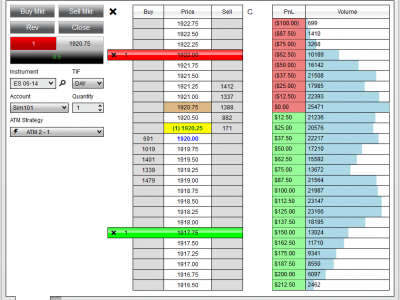

Market depth data can be viewed on a separate

Level 2 window or on a price ladder.

Because market depth is in real time, it changes constantly throughout the

trading session.

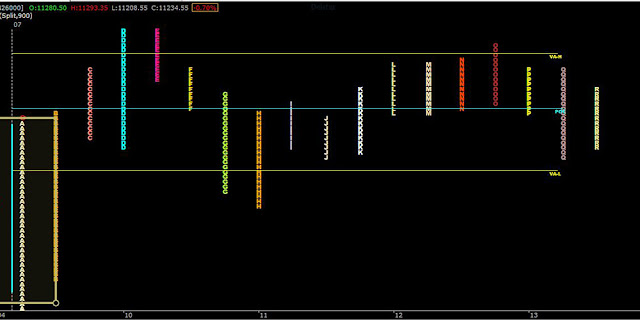

A “Price Ladder” or “DOM Display” shows each price level in the middle column.

The number of buyers at each price level on the left, and the number of sellers

on the right.

Another way to view market depth is to overlay it on a price chart, as shown in

“Charting depth” (below).This is the same data that would appear on a Level 2 window or DOM. The only

difference between the two is the visual presentation.

In this example, the levels of market depth are displayed over the right-hand

side of a price chart, next to the various prices.

Green bars represent the buy orders. The size of each green bar reflects the

relative number of shares or lots that buyers would like to purchase.

Red bars indicate market participants who want to sell. The size of each red

bar reflects the number of shares or lots that traders would like to sell.

Level 3 Real Time Data from NSE

NSE Real-Time Data also

provides a 20 level deep order book. Actually, this is a subset of the Level 2

Data, known as Level 3.

Here, Level 2 provides market depth data up to 5 best bid and ask prices.

Level 3 provides market depth data up to 20 best bid and ask prices. Everything

else in Level 3, is the same as Level 2.

More details of the various Levels Provided by NSE can be

obtained from the NSE Website (Data Vending Info).

The Tick by Tick Feed is provided by the NSE.

This feed consists of each and every order or a change in the order. It

includes:-

·

A new order

accepted & added to the order book

·

Any order

canceled

·

Or, any order

modified and added to order book. It contains the new and old image (i.e. price

and quantity) of the order.

·

Trade – when

any order is fully or partially executed.

·

Market Orders

added to the book

·

Fully or

Partially Traded Market Orders

This feed sends a huge amount of data. For

just one symbol, say, the NIFTY future, the number of trades goes to 200 – 300

trades per second.

And this much data is not easy to handle. It

also needs better applications to churn out meaningful information from this

data.

This feed works best on collocated servers and LAN of the exchange.

If you required this feed at your location, from a data vendor, you would need

a leased line and also a specific software different from Amibroker or NinjaTrader, which is able to crunch the huge data flowing

from the exchange with micro second-time stamps.

And if you were able to do that, you would also need to be able to trade

instantly.

Therefore, this feed is not for the retails traders or fund houses. This feed

is best suited for High-Frequency Trading (HFT) with servers co-located at the

exchange.

Main Difference between

Level 1 and Level 2 Market Data?

If you are a new trader, then you only need

level I market data. You can always add Level II data, later, if you wish.

Level 1 market data provides all of the trading information that is needed to

display the Price Charts. This is what

you will use to perform Analysis and make trading

decisions.

For many traders, watching the constant flurry of changing bids and ask Prices on the Level 2 will result in

information over-load. This could actually have a detrimental effect as opposed

to a positive one.

Can Level 2 Data be useful?

Yes, because it not only shows, where the

price is now but where it is likely to be in the near future.

Some trading strategies might require Level 2 market data. Typically, this data

be used in a scalping strategy, where traders take advantage of short-term

patterns are seen in the bidding/offering activities of other traders.

Also, for example, if a big fund wished to sell 5 crore shares in a

medium-sized company.

Using level 1 data, they may see that the highest bid price on the market is

Rs.2000 for 50k shares. The fund manager will now know that they can

sell their first 50k shares at Rs. 2000.

However, the fund managers will have to accept less in order to shift the rest

of their holding.

Therefore they would then trade at the next best bid price, and so on,

receiving marginally less for their shares each time they exhaust an order in

the market place.

It would, therefore, benefit the fund manager to be able to assess how quickly

the competitiveness of the bid prices trail off before they place a large

block of shares for sale.

This is called – being able to see the ‘depth’ of the market. If the

competitive orders are thin on the ground then they may decide to delay their the sale or only sell a small batch.

As a result of strong demand; the fund may be able to offload its shares

without moving the share price down too much and achieving the best deal for

their account holders.

Conclusion

This demonstrates why level 2 data is quite pointless for your average

day trader. Trading in such small quantities will rarely exhaust the bid

price or offer price which they could see on level 1.

Other than very large institutions, the only other viable market participant

who could fully utilize such data would be a high-speed, automatic trading the algorithm which pays extremely low commissions.

Hope, I have been able to give you an insight on the various Levels of RealTime Market Data & their implications in trading.