Choosing Career in

Indian Stock Market

The Stock Market in India

has fascinated general Indian masses for long, perhaps due to the high (mostly

instant) gains through the investments. In earlier days, people used to

associate tags such as fortunate and risky with the Stock Market, because of the lack of knowledge and Investments made on either guesswork or the Guidance of others

who have tried their hands in this market. However, the mystery of the Capital Markets has

faded away over the period of time; people now understand that there is

100% Technical Analysis behind the Success in Stock Market.

It

is not about the guesswork and the capital markets are much more than picking

stocks and making big money. It is an assorted and complex field and the recent

generation is more than willing to take up this challenging and rewarding career in Indian Stock Market.

If

you are one of those who want to have a successful and long term career in the

capital markets, then here some of the helpful tips for you:

Have clarity of your Goals

The Stock Market is not just about picking up

the stocks randomly, waiting for it grow and payoff. There is much more to it,

there are many different roles in the hierarchy. Within the capital markets you

can choose to work in Broking and Distribution, Asset Management, Wealth

Management and the ECM side of Investment banking. Have a clear idea of

which of the areas interests you the most, so that you can get prepared

accordingly.

Become a subject matter expert

Now

that you know where which role appeals you most get a relevant degree and/or

relevant educational qualifications; although there are many people who Work in Stock Market, without related

educational background, getting qualified for a particular role will set you

apart from others in this competitive field.

Certify yourself

Getting

yourself certified with a few of NCFM and NISM certifications (in addition to

the mandatory ones such as the research analyst certification for the research

analyst profile) portrays your seriousness towards your career. If you are

looking for a job in this industry, you may also consider adding a CFA or a CA

certification to your profile; though it’s not mandatory it is certainly a

great advantage for your career.

High Levels of integrity

When you work in the stock market, you will

have to manage money matters on behalf of others, particularly when you work

with large and successful capital markets oriented companies. Therefore, it is

your moral and ethical responsibility to be ethical towards that money. The

markets are governed by SEBI. SEBI performs systematic audits time to time, in order

to ensure compliance, so, only someone with very integrity can survive for long

in this industry.

Work under a mentor

In

the stock markets, there are lots of Analysis and

predictions are required to be made. On the initial stage of your career, you

may not be able to make accurate predictions, despite higher education that you

have taken. Working with a mentor who can help you rise above such situations

and help you cope with different situations will help you make a better

decisions and work independently after some time.

If

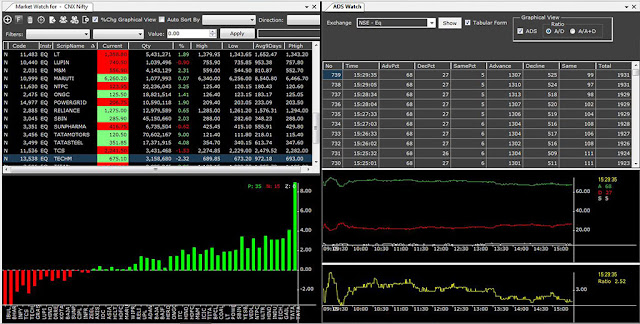

you single-mindedly follow the stock markets, understand how the Sensex and Nifty work,

and have an ability to handle finances, then a career in stock

market can bring to you great success and growth.

Here

is a list of top institutes in India offering stock market-related courses:

Institute of Company

Secretaries of India

ICSI

House, 22,

Institutional Area Lodhi Road,

New Delhi 110 003,

EPABX LINES: (011) 41504444, 24617321-24-, 24644431-32, Fax: 24626727

Website: http://www.icsi.edu/

Course offered: Post-graduate membership course in the capital market and

financial services

Institute of Capital Market

Development

1965,

Arya Samaj Road,

Karol Bagh, New Delhi-110005

Course offered: One-year postgraduate programme in Fundamentals of capital

market development.

All India Centre For Capital

Market Studies

D.

C.

Byte Institute of Management Studies and Research,

Nashik-422 005,

Course offered: One-year post-graduate programme in capital market

studies, in collaboration with the Mumbai Stock Exchange Training Institute,

leading to a diploma from the University of Pune. The course is open to

graduates through an all-India selection process.

Mumbai Stock Exchange Training

Institute

Stock

Exchange Building,

Fort, Mumbai,

Course offered: Certificate courses are run periodically throughout the year

B/303,

Ventex Vikas,

M.V. Road,

Andheri East,

Mumbai,

Course offered: One-year correspondence cum lecture course leading to a

diploma in financial and Investment planning

Road

No. 3, Banjara Hills,

Hyderabad,

Course offered: Chartered Financial Analyst Equity Research.

The Orion Institute of Capital

Market

S-

11, Adarshini Plaza,

91, Adchini, Aurobindo Marg, New Delhi

The UTI Institute of Capital

Market

Plot 82, Sector – 17,

Vashi, nave Mumbai – 400 705