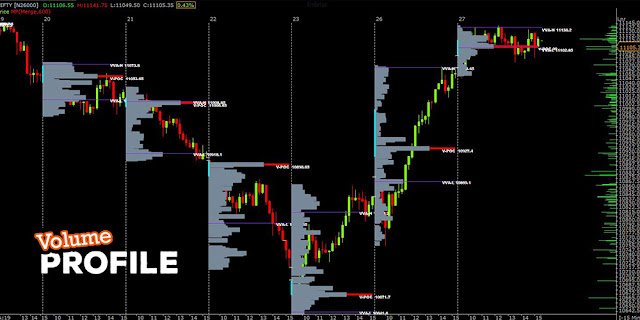

What is Volume Profile?

Volume Profile is a visual

representation of how much volume occurs at each individual price over a

certain period of time. It helps traders to identify support and resistance. By

looking at the volume we can see where the most activity is taking place

historically.

The important ingredients of

Volume Profile include:-

·

Value area: The Value Area represents the range of volume that

contains 70% of a day’s trading activity. Prices in value areas are the most

acceptable prices.

·

Initial Balance: Initial Balance represents the first

hour of trade to predict how the market will perform during the rest of the day or to

identify volatility to avoid trading.

·

VPOC: The price that recorded the highest trading

activity.

·

Value Area High (VAH): The upper level of the value area.

·

Value Area Low (VAL): The lower level of the value area.

This is used to identify Support and Resistance. Volume The profile also includes High volume nodes (HVNs) where prices are deemed as fair

prices. These are the prices where traders spend most of their time. HVN

attract market activity. In contrast to HVNs, where prices are deemed as unfair

prices are known as Low volume nodes ( LVNs), at these prices, traders spent no

or little time. LVN tends to reject market activity.

How does

volume profile works?

Basically, Volume Profile takes account of total volume

traded at a particular price level during the specific duration and divides the

total volume into either “buy volume” or “sell volume”. This makes easier for

the trader to understand the information.

How to find

Support and Resistance?

The first and most important use of the Volume profile is

to find basic support and resistance levels. It is a reactive method to

identify support and resistance. This means the method relies on past price

movements and volume behavior unlike proactive methods (such as trend lines and

moving averages) which are based on current price action and analysis to

predict future price movements.

It can also be helpful in applying meaning to price

levels where the market has visited earlier.

Bottom Line

Volume Profile is an exceptionally valuable tool for Technical Analysis for the traders. It is a charting tool that does a

variety of things that are helpful while trading

The data that is provided by Volume Profile is quite certain.

While in its simplest form, it is a great reactive method for analyzing and

finding traditional support and resistance areas. It is capable of comparing a

real-time event (the current day’s open) with historical events (the previous

day’s profile) and make the best decision based on the connection of the two.