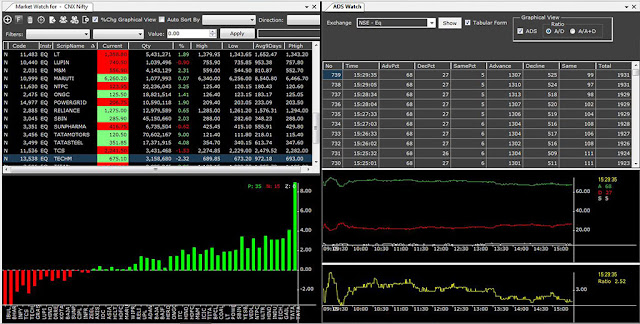

Studying Breadth of the Market

Market Breadth – ADS

(Advance, Decline, Same) Feature in TrueData Cheetah is similar to the breadth indicator. Breadth Indicator

measures the number of advancing and declining stocks using a mathematical

formula. It reflects Market Sentiments.

Looking at ADS, a Trader

would get an idea about how a Market Performing.

It also has a third line ‘Same line’ which shows the percentage of stocks which

are neither advancing nor declining, it shows stock with no % change in their

close price.

The advance-Decline line can be better understood by Studying convergence and divergence:-

Convergence

Bullish-

when advance line converge towards decline line from bottom to above, then it’s

a bullish convergence. It generally shows signs of trend reversal in the market

from Bearish to Bullish.

Bearish

– when advance line crosses the decline line by moving down, it leads to

bearish convergence. This typically indicates a bearish reversal in the

market.

Divergence

After convergence, ADS forming new highs or new lows. This can be used

to identify a trend where fewer stocks are declining and the decline in the

index may be nearing an end. Thus a trader can identify a stock in a group by

using ‘% chg’ for trading.

Similar trading pattern could be followed in Bearish divergence.

Ratio

A/D ratio if above 1.25 shows a bullish trend in the market whereas if

below indicates a Bearish Trend, if A/D ratio is between 0 and 1, this indicates bearish to choppy

market. Using A/A+D formula shows a strong bullish trend if above 0.60 or

bearish trend if below 0.50.

This TrueData

Cheetah feature is

therefore significant while trading as it gives you an overall view of the

market.