When

we take our first step into the trading game, we choose the best resources for

ourselves. For rookie brokers, it can be a tad bit tedious to look for

the Best Technical indicator.

The

purpose of using Technical indicators is to follow the action and it influences

the way you interpret trends. Be it on positions and broad averages or the type

of opportunities that pop-up in those researches of yours.

Technical

indicators sure can be attractive and appealing, especially to those who are

putting their foot in the market. The indicators return a clear sign on whether

or not you should buy or sell the shares. One can interpret technical

indicators very easily across different markets.

Novices

usually wonder as to why technical indicators are of great importance in the

market.

Here’s

why?

When

you don’t use technical indicators, it will be difficult for traders to assess

the prevailing volatility of the market, the strength of a trend or whether

market positions are overbought or oversold.

Before

I go on listing the best technical indicators for you, there are three types of

technical indicators which you should unquestionably know –

Trend-following Indicators

Trend-following

indicators are meant for ascertaining the trends and measure the strength of a

trending market. Which yes, it can be told by looking at the price chart,

however, it is a bit difficult to measure its strength and to spot a trend when

it is early in its transformation.

Momentum Indicators

Momentum

indicators measure the strength of current price fluctuations in previous

periods. These indicators fluctuate between 0 to 100 which provides signals

whether the market conditions are overbought or oversold.

Volatility Indicators

Volatility indicators measure the volatility of the

underlying instrument. Traders chase volatility across markets to ensure they

find profitable opportunities to trade.

Here

is a list of the best technical indicators and you shouldn’t be trading without

these indicators.

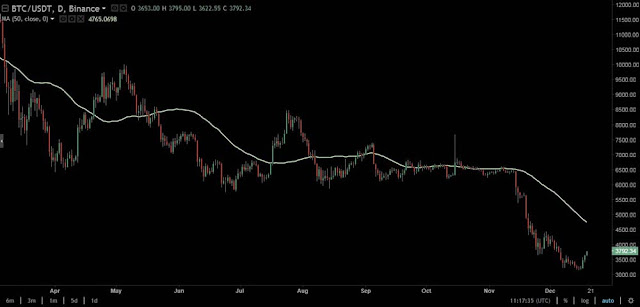

Moving Averages

These

are not only popular day trading indicators but are ideal for both –

trend-following indicator and counter-following indicator. Moving

averages show the average of the last n-period closing prices. These averages

are generally plotted on the price chart. As a new closing price comes in, the

last closing price in the series drops and thus, moving average drops.

ATR – Average True Range

Indicator

Average

True Range Indicator is one of the best technical indicators which measures the

volatility of the market by considering the following – the current low

subtracted from the current high, previous close subtracted from the absolute

value of the current high, and the absolute value of the current low minus the

previous close.

ATR indicator takes together all the average of the values for a specified period of time, which is further then plotted in the form of a moving average on the chart.

ATR indicator takes together all the average of the values for a specified period of time, which is further then plotted in the form of a moving average on the chart.

RSI – Relative Strength Index

RSI

– Relative Strength Index is one of the popular and the best technical

indicators. This indicator measures the change in current price-changes and

reverts the reading between 0 to 100. Most of the time, RSI to know whether the

market is overbought or oversold.

The reading which says above 70 is usually indicating that the market is overbought whereas a reading below 30 indicates that the market is oversold.

The reading which says above 70 is usually indicating that the market is overbought whereas a reading below 30 indicates that the market is oversold.

Bollinger Bands

This

technical indicator works on the basis of the moving average, it is ideal for

detecting the present market volatility. Bollinger bands contain three lines –

- The middle line is moving average.

- The upper and the lower lines are two standard deviations which create a band since it is away from the moving average.

We

aren’t telling you to drop other kinds of analyses and trust technical

indicators blindly. However, technical indicators can come in handy when you’re

new to the market.

You

need not worry about which one to use because we have already listed the best

ones for you (they are not in any order of preference).

And

now, we will be addressing a few frequently asked questions –

Which

are the best indicators to identify short-term trend reversals in stock market

trading?

To

explain in simple words, a trend reversal is more or less your entry and exit

in the stock market. When you identify the best reversals. You will be on the

path to trading success in no time. There are consequences to false reversal

such as missing potential trading setups or you will have to scramble back to

be back in the flow.

With

that being said, here is the list of best technical indicators to find

short-term trend reversals –

Moving Average

One

of the favored methods of using a moving average is by examining its direction.

The strength of using moving averages is that it allows you to use a few of

them to keep a track of differing degrees.

However,

it comes with a drawback and that is if you use it too much then you will end

up turning its strength into a disadvantage.

Donchian Channel

Donchian

channel has maintained its status as a powerful trend tracking tool. In fact,

Donchian Channel is grounded with price action. It is not a typical indicator

with hard-to-grasp formula.

This

indicator has two lines. This helps in attaining the highest price and the

lowest price attained within the lookback period.

In

simple terms it means, defining a price range by using historical price action.

Moving Average Convergence

Divergence (MACD)

The

two moving averages of different periods diverge, when the trend strengthens

and the moving averages converge when the trend weakens.

A

price divergence is a very compelling reverse signal and happens to occur when

price and an oscillator disagree.

Which

indicators are the most useful when combined with technical analysis?

There

is a close relationship between technical indicators and Technical Analysis. Technical indicators help technical

analysis respond to any important volatility or price action as it takes place

in the price of a stock.

Technical

analysis can help the traders to determine the levels of support and resistance

in price whereas technical analysis helps the traders to determine whether the

price of the stock has dropped lower or climbed higher and to break out of the

last price range.

With

the combination of technical analysis and technical indicators, it helps the

traders to predict prices and start undervalued security with the right price

size at the right time.

We

have enlisted a few of the most useful technical indicators when combined with

Technical Analysis.

Relative Strength Indicator

Relative Strength Indicator or RSI is a momentum (the

rate at which price rise or fall) oscillator. RSI helps to compare the

magnitude of recent gains and losses over a particular period for measuring

speed and variation of price movements of a security.

This

indicator can show, whether the product is overbought or oversold by measuring

the magnitude of recent price changes.

Moving Averages

This

is one of the oldest and the most popular technical indicators used by traders

in technical analysis. It is more or less an average of past prices. It creates

a smooth price data and a single flowing line.

Stochastic Oscillator

This

is one of the most reliable momentum tools which help traders to measure the

current momentum, especially when compared to the lows and highs of a

historical set of prices.

The

prices tend to close near the high in an upward-trending market, and tend to

close near their low, in a downward-trending market.

Which

is one of the most reliable technical indicators for a Bullish Trend?

Technical

indicators are ideal for predicting the forthcoming changes in the price of the

stocks. For carrying out your Stock Analysis, trader can use the

combination of different charts and technical indicators.

Some

of the few reliable indicators for a bullish trend are –

Bollinger Band

This

indicator helps you to analyze the direction in which the stock price is moving

and also helps to find the market volatility. It consists of two bands, Upper

Band and Lower Band. For particular security, lines are used to depict the

volatility range on the basis of a standard deviation.

Stochastic Oscillator

We

compare one observation point in the current base with the highest and lowest

points from a specified range. It further helps to predict the strength of the

current trends.

What are the best technical

indicators for Intraday Trading?

Following

the basic intraday tips is a common practice for traders, be it a beginner or an

established trader. Trading strategy for every trader change with time.

To

maximize returns, it is necessary to understand the markets. Trading indicators

can help in maximizing revenue, If used with a comprehensive strategy.

The information offered by intraday Trading

Indicators –

- The direction of the trend to ascertain the movement.

- The lack of existing momentum within the investment market.

- Profit potential due to the volatility.

- Determine the popularity through volume measurements.

Here are the best technical indicators for intraday trading –

Moving Averages

If

long-term averages are more than short-term averages, it is an indication of a

bullish market trend. Traders may take a buy call with specific strategies like

stop-loss either at retracement support or long-term moving average and

vice-versa. It can help users to earn decent profits.

Bollinger Bands

There

is a great chance for the price to increase in the future only if the stock is

trading at a price prevailing below the Bollinger Band lower line. Traders can

sell the share when the current stock price is over the upper line.

Using

intraday indicators help to avert risk and place appropriate traders based on

market sentiments and technical analysis.

It

is not entirely true when they say that trading is based on our gut, rather it

is a blend of whole other lot of analyses, indicators, and gut.

Our

only advice is to keep trading and be safe.

And

on that note…

Adios!